In residential real estate investment, there’s always contention between investors that prefer single-family investment properties and those that prefer multifamily investments.

We’ll go ahead and say this: absolutely every investor will have their own preferences. Every type of investment will have its own pros and cons, and what attracts certain people may not sway others. What might be your deal-breaking flaw might not be someone else’s.

That said, there are some very clear advantages and disadvantages between single and multifamily properties that should be considered. As a real estate investor, you may want to experiment and try it out for yourself!

Many investors choose to start with single-family properties simply because the barrier to entry is lower. Some prefer to invest in both, while others prefer to deal exclusively in multifamily housing. Others specialize in something else altogether!

There’s still more out there.

Remember: there are endless variations in the types of real estate investment. If neither single or multifamily investment properties excite you, maybe something else will. Commercial real estate, like office and retail space, is huge.

That said, for the purposes of this article, we’re focusing on residential real estate, and primarily on your average single-family homes and on the most common type of multifamily property: apartments.

A Rundown of Single-Family Homes

We all know them—in fact, they probably don’t need an introduction! But for the sake of being thorough, single-family properties are just that: a detached property in which only one family (or tenant) lives. These are houses. As an investor, you’re buying homes and renting out the entire home to a single family or tenant for the term of a lease.

These are what most residential investors start off with: there’s a low barrier to entry and it’s a lot easier to start off with one investment property than to start off with an entire apartment complex. That said, there are variations on the single-family homes (SFH) to consider that bear keeping in mind.

Vacation Homes

A vacation home, whether it’s a chalet in the mountains or a beach house in Florida, are all about luxury. Unlike regular single-family rentals, these are all about a luxury experience and top-notch quality. The cost of renting is usually at a higher price point, and they’re renting out by the day, week, or month, depending on the lease structure. Because these are seasonal, vacation homes come with a unique set of challenges when it comes to vacancies and upkeep.

Student Housing

Student housing isn’t specially licensed by a college or university, nor does is exclude non-students (after all, you can’t do that based on the Fair Housing Act). You can, however, make your lease agreement accommodating for the semester cycle of a nearby institution. Your terms will be shorter, but you can charge more for a shorter term lease and include summer terms.

Some investors fear that renting to students runs too high a risk of damaging their properties with raucous parties and negligence, but hefty penalties for bad behavior and anticipation for that kind of thing worked into your rent and lease agreement can help mitigate any damage caused by trouble.

Plus, in many cases, it’s the parents who will be signing the lease, and some may even opt to pay for the entire semester up front!

Townhouses

Townhouses are interesting. You buy them like you would any single-family property, but in spirit, they’re like a multifamily property. They do come with HOA fees that can be hefty, but they do take care of a lot of common amenities and are another extra set of eyes on your property and your tenants. Price-wise, they’re typically less expensive than a single-family home. It’s the HOA fees that are the real catch, which may or may not be worth it to you. They are certainly a viable option, however, and worth checking out as an alternative.

Condominiums

Condos also come with HOA fees and, like townhouses, are single-family in purchase but multifamily in spirit. They share a building and walls with others like an apartment, but you buy a single unit and rent out a single unit, rather than buy the entire building (though you could also buy and rent out multiple condos within the building, if you wanted to).

A condominium can easily fall under the “vacation” umbrella in terms of marketing, perhaps more easily than a single-family home.

There are a lot of considerations that should go into choosing a condominium, however: namely, how well it’s kept, what the management is like, how big its reserve funds are, what are condo rules, guidelines, and bylaws, and what monthly fees you will be contending with.

Introducing Multi-Family Properties

For most of us, multifamily properties means “apartments,” and, in most cases, that’s true. We think of high rises or complexes. As a real estate investor, you would own the apartment building or complex and rent out each unit, multiplying your streams of income.

The primary and most attractive advantage to multifamily properties are these multiple streams of income. It mitigates the impact of vacancies and tenant turnover.

Just like single-family properties, there are a few variations to consider. Really, for multifamily properties, there’s one major variation to consider above the rest:

Duplexes, Triplex, and Quadruplexes

Sometimes the line between duplexes, triplexes and quadruplexes (the prefix naturally determining how many units there are) and apartments can get a little blurry.

The primary distinction is that these ‘plexes are typically still the size of a regular house. These are detached or semi-detached properties that include a handful of multifamily units. Unlike full apartments, they aren’t so expensive on the front end that the barrier to entry is too steep for new investors.

In fact, these might be a good place for new investors who are interested in multifamily investment properties to start.

With the variations out of the way, we can dive into the real factors that matter when weighing what makes the better investment. For the full picture, we’ve including the perspective of owners, property managers, and tenants, taken a variety of factors, and seen which type of property has the ultimate advantage in each category.

The Factors to Consider in Each Type of Investment Property

For Owners

Upfront Cost

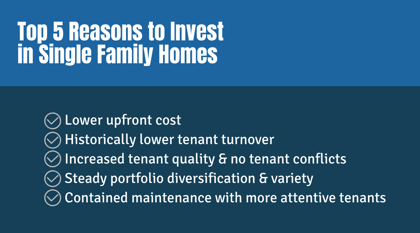

Simply put, it’s cheaper to buy a house than it is to buy an entire apartment building. That why for many investors, especially those just starting out, single-family properties are the best launching pad for their investment careers. Sure, they aren’t fool-proof (and what investment is?), but they’re reliable given the right foundation of knowledge.

Saving up for your first investment property this way is so much easier than starting off saving for a multifamily property. That said, multifamily properties are easier to scale unit-per-unit. You’re getting more income streams per single purchase. Adding multiple properties in multiple markets, however, will take more time and capital.

With single-family properties, diversifying can come at a slow, steady pace that adds up to long term success—with the advantage of the variety you want!

Advantage: Single-Family. Cheaper to buy outright, though scaling unit-by-unit is arguably slower.

Buying and Selling

No matter how you slice it, there will always be a bigger pool of buyers for single-family homes than there will be for multifamily properties. With the latter, you’re narrowing yourself down almost exclusively to other investors and real estate professionals. Single-family homes, however, include casual homeowners! There’s just more people in that pool, not to mention a bigger supply.

Some would argue it’s harder to sell SFHs, but that’s only if you’re trying to sell your entire portfolio, rather than individual properties.

Advantage: Single-Family. There are simply more people buying and selling these kinds of properties.

Tenant Turnover

Typically, tenants stay in single-family units for far longer than they do in apartments. A National Apartment Association study put the turnover rate at 54% in 2014, while the turnover rate for single-family homes was down around 25%—significantly lower.

Considering how costly vacancies and tenant turnover can be for investors, reducing that time is crucial. Despite apartments allowing multiple streams of income, having frequent vacancies certainly reduces that magnified impact.

Why do tenants tend to stay longer in single-family rentals? Perhaps for work and school, perhaps because they don’t have to deal with neighbors, or maybe because it just feels more like a home where they can settle down.

Advantage: Single-Family. Even if vacancies are costly, the rates are much lower among single-family homes.

General Demand

While demand for rentals of all kinds are on the upswing for both single and multifamily rentals, the supply is tighter for single-family rentals. The demand tends to be higher for single-family properties, as they’re seen as more desirable—they don’t carry the stigma that apartments still sometimes do. That’s not to say rental demand in apartments aren’t high—it is!

In fact, rental demand nationwide is up. Between now and 2030, there’s an expected 59% growth in households that choose to rent instead of own. Both single and multifamily investors don’t have much to worry about it terms of demand: rentals even now are at an all-time high of desirability, and projections show that only going up from here.

Advantage: Mixed. Demand is up for rentals of all kinds!

Ability to Scale

While the barrier to entry is lower with single-family properties, they are more difficult to scale on a unit-by-unit basis. While it takes more capital upfront to buy an apartment building or complex, you’re adding dozens of income-generating units to your income stream. If you want to have a dozen individual streams of rental income with single-family homes, that’s twelve houses you’re going to have to find and buy. That’s a lot of work!

While it’s perfect for a slow-and-steady approach, if you want to scale quickly, it’s rather difficult.

Of course, it’s easier to diversify your portfolio steadily, over time in other markets with single-family homes. But if we’re talking strictly unit-by-unit scaling, the advantage rests solely with multifamily properties.

Advantage: Multifamily. Easier to have market diversity with SFHs, but easier to scale by sheer units with multifamily.

Vacancy and Risk

The biggest bugaboo for a single-family rental isn’t the vacancy rate, it’s what happens when it is vacant. No tenant means no income, period. With an apartment, a few vacancies doesn’t meant your positive cash flow comes to a standstill. You have more wiggle room to fill those vacancies. With a single-family home, the stakes are higher.

That said, it can still be a mixed bag! Most people will try to convince you that multifamily investments are better because they mitigate risk. A vacancy isn’t a big deal because you have more units to sustain your income while you find a tenant and handle the turnover.

Once you reach a certain number of single-family properties, however, it doesn’t stay an issue for you, either. You’ll be able to handle single-family vacancies.

It really depends on your personal situations, the size of your portfolio, and how well you personally plan and anticipate vacancies. It comes down to your personal risk tolerance.

Advantage: Mixed. Risk is mitigated by multiple units in apartments, but after a certain point, it’s not as crucial for an investor with multiple SFHs.

Management Expense

Typically, property management companies will charge a bigger chunk of rental income (around 10%) for an SFH compared to a 4 or 7% rate for an apartment. That’s why a lot of new investors choose to landlord themselves when they’re just starting out! Single-family homes can be more expensive to manage.

Advantage: Multifamily. Management expenses are generally lower.

Financing Limits

Like it or not, there are limits to traditional financing when it comes to single-family homes. That’s not to say you can’t get creative: there are plenty of ways to finance, like through private-money lending.

But as it is, traditional financing limits are still going to stick you to a 10 loan limit and 25% down.

With multifamily properties, buying with private placement offerings or other alternative financing strategies, especially when you have the know-how to back it up, you can easily finance your initial purchase with very little of your own money, pay off your initial financiers, and be earning pure income in no time at all.

At the end of the day, it’s more about your financing strategy than the type of property you choose.

Advantage: Mixed. There are alternative financing strategies out there, but the traditional limits can be bothersome.

Maintenance and Repair Costs

The upfront cost of the property isn’t the only consideration: obviously, ongoing costs are a big factor. In apartment buildings, regular wear-and-tear accelerates. Tenant traffic is higher, tenant turnover is higher, and you’ll simply find things needing replacing and repairs a lot more.

On top of that, remember that when you do property renovations, renovating an apartment means eventually renovating every unit...and multiplying your costs. For a single-family home, you can more easily custom-tailor the property with targeted, unique fixtures that aren’t focused on being standardized.

Advantage: Single-Family. Higher volume and turnover means higher costs in multi-family.

For Property Managers

Quality of Tenants

Because single-family rentals are more costly in rent, they tend to attract better quality tenants and can be more easily vetted by managers. In general, having one tenant or family to deal with means managers can dedicate more time to thoroughly check tenants and select the best match for your properties. It leaves less room for mistakes and weeds out less desirable tenants from the outset.

Advantage: Single-Family. Higher costs and a single unit means more time can be taken to vet tenants and ensure quality.

Tenant Conflicts

In apartments, tenant squabbles can be a major source of headaches for your property managers. With single family rentals, it’s simply a non-issue! Your tenants won’t be bothered by other tenants and your manager won’t have to play peacemaker or worry that one tenant will stop paying rent in protest because of something another tenant did.

That said, it’s important to note that you can’t evict a rowdy neighbor like you can a rowdy tenant. Sometimes a single-family conflict with a neighbor is harder to resolve because, as a manager, you don’t have the same authority over bad neighbors. Still, your tenants are more likely to keep to themselves and avoid bad neighbors, as they’re more able to.

Advantage: Single-Family. Conflicts are contained between the tenants and the manager, not between tenants.

General Maintenance

Obviously, one tenant in one “unit” means there’s less to break and less to maintain. Easy enough! While most investors will have more than one property to manage, your manager won’t have to go between twenty units in a row fixing problems, or worry that one leaky pipe flooded the downstairs unit. Maintenance issues stay contained and are limited to that property and that property alone.

Not only that, but tenants in single-family homes are much more likely to take care of small maintenance tasks themselves: they’ll usually mow the lawn, shovel snow, and do a few of those minor repairs that apartment tenants would usually trouble management over. There’s more a feeling of ownership there than they would have in an apartment.

On top of that, there are no common areas to worry about: no playground, laundry rooms, pools, walkways, or landscaping to really fool with.

Advantage: Single-Family. Tenants tend to be more responsible and there are no common areas to maintain.

Repairs and Management

Property management companies may get a bigger chunk of the rent every month, but there’s a reason for it: they’re harder to manage. Units aren’t all in one place and one building, meaning managers have to drive around to get to each property. Fixtures won’t be standardized between single-family homes, meaning repairs and replacements aren’t as clean-cut as they would be in an apartment. Generally speaking, it’s more legwork for the managers.

Advantage: Multifamily. Standardized fixtures in a centralized location.

For Tenants

While you may not think the tenant experience is directly related to your investments, it really is! Knowing how your tenant interacts and engages with their rental, whether an apartment or home, is important in knowing how you can improve upon your own systems and strategies, no matter what kind of investments you decide to pursue:

Homeyness

For tenants, a single-family rental home feels just like that: a home. They won’t spend too much time wishing they were owning a home because living in your rental will feel like one. Apartments can feel cramped and subpar. A rental house can feel like a real home, and that feeling can keep them staying with you for years. Not to mention they don’t have to take care of maintenance!

Advantage: Single-Family. It’s the feel of a home with the convenience of an apartment.

Neighbors and Privacy

No apartment means no rowdy neighbors, no loud pets, no thin walls, and no feeling like you can’t get away from other people. Other tenants can be a pain, but tenants in a single-family unit can almost always ignore their neighbors if they want to. It’s simply more private.

Advantage: Single-Family. No sharing walls!

Amenities

Apartments typically have more amenities. That’s just how it is: whether it’s an on-site gym, pool, laundry facility or other perks, the big draw of apartments really come down to those special offerings. While some tenants may not care about amenities, many do.

Advantage: Multifamily. Common amenities are a big draw.

Affordability and Demand

We know that demand for single-family homes is higher: there simply aren’t as many of them available either. Supply is lower. It’s so much easier for a tenant to find an apartment unit than to find a rental home. Though it may be worth the hunt, they also tend to be at a much higher price point, and not often for much more space in terms of square footage, depending on their region.

Advantage: Multifamily. Abundance of apartments means they’ll almost always be able to find one, and one they can afford.

So really...which is better?

We can’t say we have a definitive answer for you: like we said in the beginning, it all depends on personal factors. Not only does it come down to your personal goals and preferences as an investor, but there are other factors to consider.

Ask yourself:

- What is my financial roadmap for acquiring, maintaining and scaling my investments?

- Where do I want to be in 5 years? 10? 20?

- What is my personal tolerance for risk?

Experiment. Try something new. You may find you really enjoy investing in one type of property over another—you may find you love both! Your circumstances, personal capacity, strategies, and goals will all dictate your path.

Weigh the pros and cons for yourself, do your homework, and venture out.

The Simplest Way to Invest in Single-Family Properties

Turnkey real estate allows investors to “turn the key” — taking the house hunting out of the equation and allowing you to step in and start earning passive income immediately.

While no investment is 100% passive, we have it pretty close for you. With turnkey real estate investment, you purchase hand-selected properties that have already been renovated and are already generating income. With our Premier Property Management on the job, you can rest easy and focus on the big picture while we take care of the details.

With opportunities in markets like Little Rock, Oklahoma City, Dallas, Houston, and Memphis, there’s never been a better time to get started with Memphis Invest.

------------------------

Want to learn more before you get started? Research out quality company

and the Turnkey real estate advantage here...