Leverage is one of the big selling points where real estate investment is concerned. It makes sense why – it allows investors to use less of their own money to acquire valuable, income-generating assets. But, like all things, utilizing leverage comes with risks. While the advantages are significant, every investor must consider the pros and cons and decide how much to leverage.

3 min read

The Pros and Cons of Using Leverage for SFR Acquisitions

By Chris Clothier on Tue, Nov 7, 2023

3 min read

7 Tips to Fast Track Investment Property Financing

By Chris Clothier on Tue, Mar 14, 2023

Buying investment properties is a process. If you’ve ever purchased a home with bank lending, you know just how it is – a complex process of sending, signing, and receiving documents. Then there’s the appraisal, closing, and everything happening behind the scenes.

3 min read

7 Principles that Help Protect Your Credit Score

By Chris Clothier on Thu, Feb 11, 2016

No matter what method of financing you as a real estate investor pursue, your credit score is always paramount to both opportunity and success in the business. Your credit score goes hand-in-hand with your reputation: except this time, it’s all money. So much can hinge on just that number.

Real estate investors, who often deal with financing with banks, private lenders, and partnerships, need to do everything they can to keep their credit score well above average. You want a glowing record so that you never have to worry about not being approved on financing for your next investment property.

So real estate investors—here are a few tips to put in your tool kit.

4 min read

How Crowdfunding May Change Real Estate Investment as We Know It

By Chris Clothier on Fri, Jan 29, 2016

2015 was the year that crowdfunding in real estate investment really took off. Instead of looking to REITs, investors have been increasing banding together in new ways to crack bigger deals and achieve their dreams.

Even though the notion of crowdfunding in real estate is a very new concept, it’s already raised hundreds of millions of dollars. In 2012, according to Sourceable, only about $2 million were involved in real estate crowdfunding. In 2015, it was well over $2 billion. It’s poised to change the industry as we know it.

But how? What has crowdfunding already done for real estate investment? Would does the future look like? What limitations are there?

First, let’s look at crowdfunding so far.

1 min read

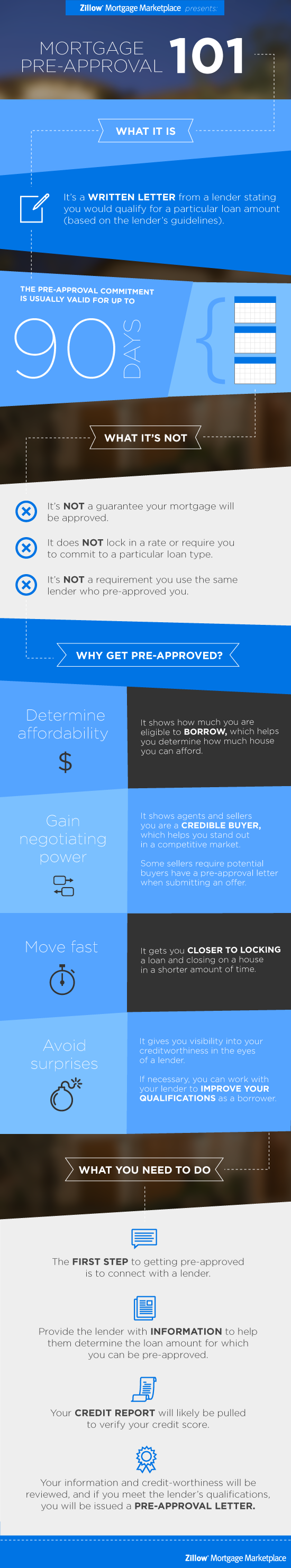

Mortgage Pre-Approval Very Important Before Investing in Real Estate

By Chris Clothier on Mon, May 12, 2014

As many of you know, if you want to use traditional financing when purchasing a property from any of the Memphis Invest companies, a pre-approval with one of a dozen different lenders is required. Why is that a requirement? As you can see with the infographic below, a pre-approval letter not only gives you a ton of credibility, but it also gives you peace of mind.